In the world of machinery, a factory’s heartbeat is its equipment. But when it’s time to invest in new machinery, a crucial decision must be made: which global powerhouse will be your supplier? The choice often boils down to three industrial giants—Germany, China, and Italy. Each nation offers a distinct value proposition shaped by its unique manufacturing culture, technological prowess, and economic model. So, when facing a significant machinery investment, how do you compare these three, and which one is the right choice for your business? This article provides a definitive, data-driven analysis for B2B professionals to help you navigate the complexities of machinery imports and make a strategic, long-term decision.

Why It Matters: A Strategic Decision for Long-Term Success

The decision to import machinery is a critical one that impacts a business’s operational efficiency, cost structure, and competitive standing for years to come. In 2025, Turkey’s machinery imports have been significantly influenced by factors such as fluctuating exchange rates and ongoing global supply chain disruptions. In the first quarter of 2025, Turkey’s imports increased by 4.5% compared to the previous year, highlighting the continued demand for foreign machinery.

Making the right choice of supplier is more than just about the initial price. It’s about a machine’s total cost of ownership (TCO), which includes maintenance, spare parts, and the reliability of after-sales support. A misstep in machinery imports can lead to unforeseen costs, production delays, and a loss of market trust. Therefore, a deep understanding of what each of these three leading nations offers is essential for securing a resilient and profitable future.

In-Depth Analysis: Germany, China, and Italy Compared

While all three are global leaders, their approaches to machinery manufacturing and export are fundamentally different. Here’s a breakdown of what each country offers.

Germany: The Symbol of Quality and Precision

Germany is often considered the gold standard in machinery imports. Its reputation is built on centuries of engineering excellence and a relentless focus on precision and durability.

- Quality and Engineering: German-made machines are known for their exceptional quality, cutting-edge technology, and robust, long-lasting performance. They are the benchmark for global standards in manufacturing.

- Technology: German firms are at the forefront of Industry 4.0 and digital integration. They offer not just machines, but complete, intelligent systems that can be integrated into smart factories, providing data analytics and automation solutions.

- Pricing and TCO: The initial cost of German machinery is typically the highest. However, its longevity, low maintenance requirements, and high energy efficiency often result in a lower TCO over the machine’s lifespan.

- After-Sales Support: Germany has a strong reputation for comprehensive after-sales support, with a vast network of service technicians and fast access to spare parts.

- Key Sectors: Germany is a leader in high-precision fields like automotive, aerospace, and advanced manufacturing.

China: The Power of Price and Scale

China’s role in machinery imports has grown exponentially, largely driven by its ability to produce at a massive scale and offer highly competitive pricing.

- Quality and Engineering: While traditionally seen as a low-cost producer, China has made significant technological strides. Its machinery is now a viable option for many applications, particularly in the mid-range segment.

- Technology: China is rapidly closing the technology gap, investing heavily in automation and digital solutions. Its strength lies in efficiently producing standardized, high-volume machinery.

- Pricing and TCO: The primary advantage of Chinese machinery is its low initial cost, making it an attractive option for companies with limited budgets or for projects with a short-term focus. However, the TCO can be higher due to potential maintenance issues and longer lead times for spare parts.

- After-Sales Support: This has traditionally been a weakness. While improving, after-sales service can be less consistent, and getting technical support or spare parts can be a challenge.

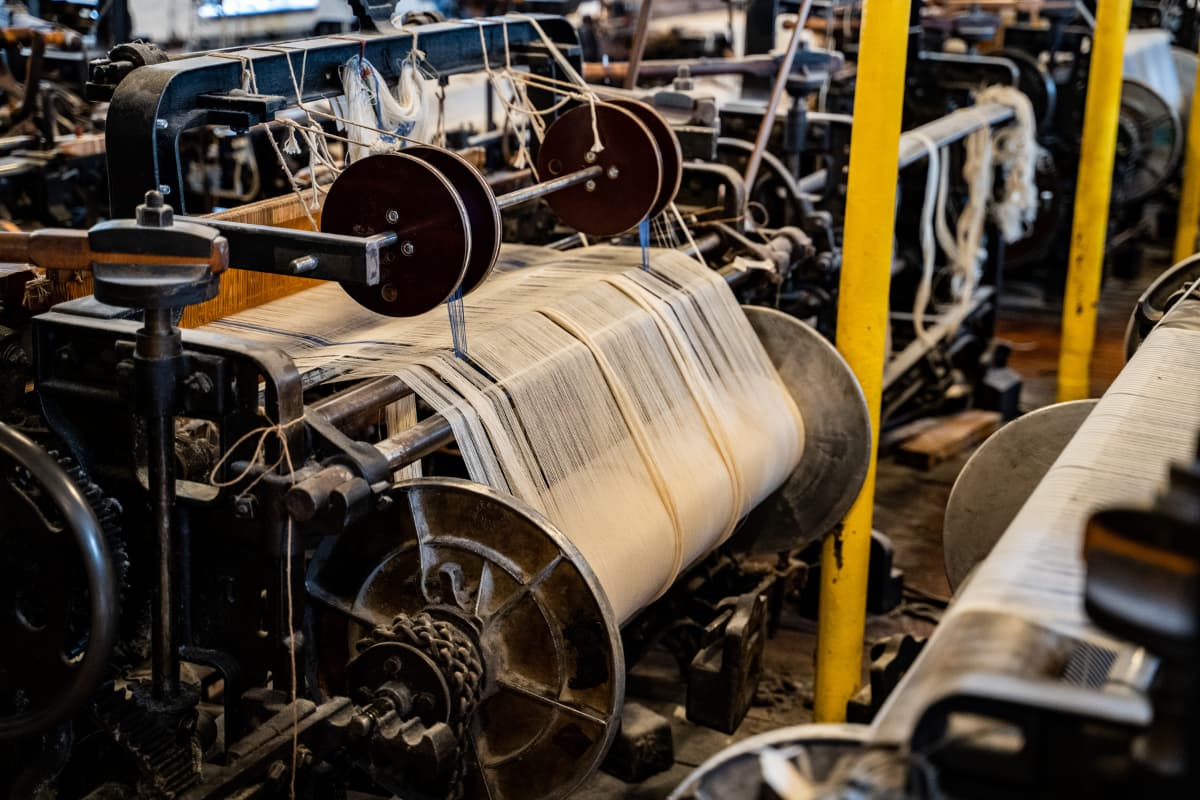

- Key Sectors: China dominates the market for general-purpose machinery, plastics, and textile machinery.

Italy: The Master of Niche and Design

Italy occupies a unique position, blending the quality and engineering of Europe with a distinct focus on design and specialization.

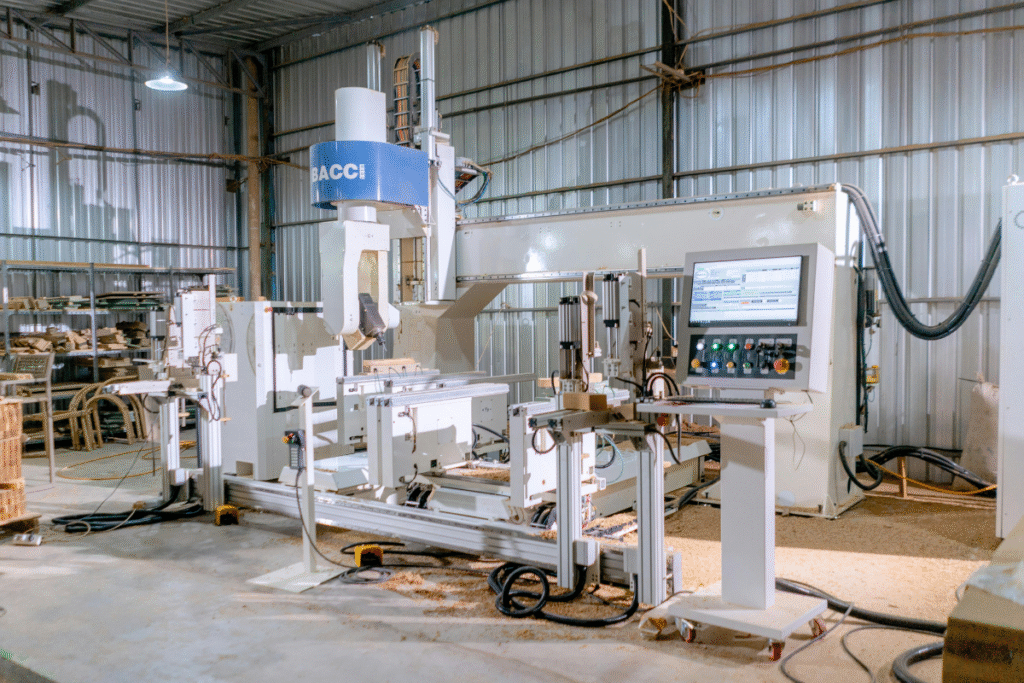

- Quality and Engineering: Italian machinery is renowned for its high quality and innovative design. Italy excels in producing specialized, niche machinery that is tailored to specific industrial needs.

- Technology: Italian manufacturers are leaders in automation and robotics, with a strong focus on creating machines that are both technologically advanced and aesthetically pleasing. They are quickly adopting Industry 5.0 principles, emphasizing human-robot collaboration.

- Pricing and TCO: Italian machinery is generally more expensive than Chinese but often more competitively priced than German alternatives. The TCO is favorable due to high quality and a strong, localized after-sales network.

- After-Sales Support: Italy has a robust network of service providers and a culture of strong customer relationships, ensuring reliable support.

- Key Sectors: Italy is a global leader in specialized sectors such as food processing, packaging, woodworking, and ceramics machinery.

Actionable Tips for a Strategic Import Decision

Choosing the right supplier is not a one-size-fits-all decision. It’s a strategic choice based on your specific business needs.

1. Conduct a Total Cost of Ownership (TCO) Analysis

- Look Beyond the Price Tag: Do not make a decision based on the initial purchase price alone. Factor in long-term costs like energy consumption, maintenance, and the cost of potential downtime. A cheaper machine that breaks down frequently or has expensive spare parts can cost more in the long run.

- Consider Financing: Evaluate financing options, including any potential government incentives or grants that may favor one source of machinery over another.

2. Prioritize After-Sales Service and Support

- Verify the Service Network: Before committing to a purchase, research the supplier’s after-sales service network in your region. Ask about technician response times, the availability of spare parts, and the quality of their technical support.

- Get References: Talk to other companies that have imported machinery from the same manufacturer. Ask them about their experience with the machine’s performance and the quality of the after-sales support.

3. Evaluate Technology and Customization

- Assess Technological Needs: Do you need a simple, reliable machine, or a complex, automated system? Germany and Italy are leaders in high-tech solutions, while China is rapidly catching up in this area.

- Discuss Customization: If your production process has unique requirements, discuss the possibility of customization with your potential suppliers. Italian manufacturers are particularly known for their flexibility in this regard.

Common Mistakes & How to Avoid Them

Even with careful planning, mistakes can be made in the machinery imports process.

- The “Price-Only” Fallacy: Choosing the cheapest machine without considering its quality, reliability, or after-sales service is a common mistake that can lead to significant long-term costs.

- Ignoring After-Sales Support: This is arguably the biggest mistake an importer can make. A lack of reliable support can lead to extended downtime, which can be far more expensive than the initial cost of the machine.

- Failing to Verify Certifications: Ensure that the machinery you import meets all local and international safety and quality standards. Importing a non-compliant machine can lead to fines, confiscation, and project delays.

Future Trends and Predictions for Machinery Imports

The future of machinery imports will be shaped by a few key trends that will affect all three nations.

- Sustained Digitalization: The push for Industry 4.0 will continue, with manufacturers from all three countries integrating more AI and IoT into their machines. The key differentiator will be the quality and reliability of these digital solutions.

- The Green Transition: The EU Green Deal and other environmental regulations will make energy-efficient and sustainable machinery a top priority for importers. This will give Germany and Italy, with their strong environmental standards, a competitive edge. However, Chinese firms are rapidly investing in green technology to meet these demands.

- Supply Chain Resilience: The trend of “nearshoring” will continue to grow, with companies prioritizing suppliers that are geographically closer and offer more stable supply chains. This is a significant advantage for European manufacturers, but Chinese firms are adapting by building factories and distribution centers closer to their key markets.

The choice between Germany, China, and Italy for machinery imports is a strategic decision that reflects your business’s priorities and long-term vision. Germany offers unparalleled quality and technological leadership, China provides a powerful advantage in price and scale, and Italy excels in specialized, design-focused solutions.

By conducting a thorough TCO analysis, prioritizing reliable after-sales service, and evaluating the technological fit for your business, you can make an informed decision that will not only meet your current needs but also position your business for success in the future.